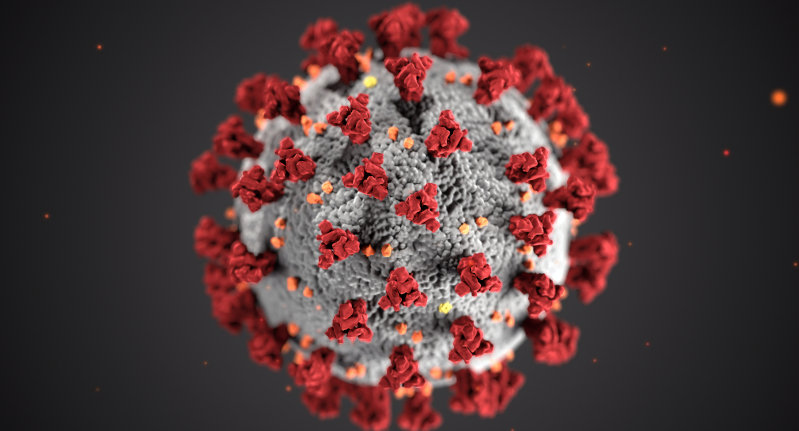

During these unprecedented times, this column has touched on the implications of coronavirus on Zimbabwean businesses, with a focus on exporting companies.

With no doubt, the coronavirus (COVID-19) pandemic has brought unforeseen challenges for businesses and access to reliable information is one of the enablers that will see companies survive.

The growing question that this article will attempt to answer is on how COVID-19 affects the nation’s exports, giving practical examples and solutions.

It is more challenging for businesses that are export oriented as closing of borders and restricted movement of persons is making it difficult to supply.

With more and more people staying at home and disposable incomes going down, demand of products has gone down, especially those that are not considered essential or basic.

Demand across the world of exotic products such as high-end fashion and electrical gadgets has fallen drastically.

However, with careful planning and the necessary complementary tools, there are ways that can be utilized to assist businesses so that they can adjust and prepare themselves to confront current challenges as well as survive post coronavirus (COVID-19) pandemic.

Trade overview and closing of borders

According to the World Trade Organization, global trade is expected to plummet by 37 percent, and this will see the slow progress of Zimbabwe’s efforts to increase exports.

In January 2020, before the virus became a global pandemic, Zimbabwe had recorded exports of US$397.7 million whilst imports were US$383.6 million, resulting in a surplus of US$14.1 million.

This was a positive start as the country had recorded a 11 percent growth in exports comparing the same period last year.

Within a space of a month South Africa, which is currently Zimbabwe’s largest export market, constituting 49 percent of total exports, instituted lockdown measures that started from 26 March 2020.

As more countries confirmed cases of COVID-19, more borders closed, and movement of goods became difficult as only essential goods are being given priority.

For example, Botswana has effectively closed their borders and they are allowing only cargo to pass through until further notice.

The health ministry in Botswana issued a list of essential services which Botswana Unified Revenue Service and their immigration officials are strictly enforcing.

This will have an impact on Zimbabwe’s engineering and construction as well as FMCG sectors which had established markets in Botswana.

Undoubtedly, Zimbabwe has been highly affected by these measures as our major exports are commodities and most not classified as essential goods in traditional export markets.

Most regional countries have enforced strict border measures are making it difficult for trucks with non-essential commodities to enter borders.

With Zimbabwe’s exports dominated by non-processed commodities that are not food or medical supplies, exports will be affected, which in turn will impact on national foreign currency earnings.

Last year, Zimbabwe exported around US$3.9 million medical supplies and more than US$116 million pharmaceutical products, a figure that could have grown exponentially if there was no increased need for supplies locally – which will reduce the export quantities.

In addition, local companies are finding it difficult to meet production schedules, which in turn will affect exports of confirmed orders.

According to a recent survey by the Confederation of Zimbabwe Industries, capacity utilization has dropped to 30 percent from around 50-60 percent.

This has an impact on meeting demand should there be any more export orders.

Further to this, the COVID-19 pandemic has made it even more difficult for exporting companies to access different markets with the lockdown of multiple borders.

The result if that exporting companies are losing export revenue due to cancellation of orders.

Sectors that have been hit hard include floriculture, engineering, non-protective clothing , building and construction and agricultural implements.

To protect these sectors, there is need for financial assistance and lending institutions can consider coming up with favorable terms for businesses.

Lag time at borders and logistical challenges

With strict monitoring of border entry points, some local companies have also experienced huge lag time at borders.

In the SADC Region markets there are some entry points where truckers are being quarantined for two weeks.

In a statement recently, the Zambian Ministry of Health said that Zambia is quarantining drivers who are bringing in essentials goods and mostly coming in from the Livingstone border.

This will increase the costs of exports should Zimbabwean companies send consignments to Zambia or use Zambia as transit route.

European countries are still receiving horticulture produce and KLM cargo is operational to move cargo from Zimbabwe.

Several horticulture exporters are utilizing their service and exporting fresh produce.

However, there is reduced trade in some destination markets, especially those that depend on imports for their food stuffs..

Some global exporters are reporting huge decline in demand as limited freight and port services are taking its toll on trade

Despite the drop in some markets, demand for citrus has gone up as they are a major source of Vitamin C.

Demand for oranges and lemons as well cherries is growing in China, Asia and Europe.

Demand for fruits and vegetables like pineapples and apples has also gone up in Netherlands, which is the largest importer of Zimbabwe’s horticultural produces.

This is an outcome of consumers seeking multivitamin foods rich in antioxidants to gain what they believe is a defense against the coronavirus.

Local farmers have capacity to produce avocados, blue berries and macadamia nuts and we can leverage on this as the future of exports will be centered on heathy eating.

With such a future ahead of us, local companies can plan for this, with the aim of increasing investments in the horticultural sector.

Further to this, as local companies experience challenges due to lockdown, authorities should remain on high alert to assist the exporting companies.

At the same time, exporting companies should quickly inform relevant authorities if they face challenges at all border entry points.

This continued engagement and assistance will allow smooth movement of Zimbabwean goods between borders.

There is also need for speedy introduction of a single electronic export window to reduce the movements of traders to applying for permits.

Challenges in supply of raw materials

Some local companies have noted challenges in acquiring raw materials into the country, with some supplies stuck at borders entry points.

The major cause of these delays is that source country will not have classified these products as essential.

Zimbabwe’s biggest import country, South Africa – which supplied products and services worth around US$1.85 billion in 2019 according to Trade Map – has reduced production and this will negatively affect supplies to local manufacturers.

Other biggest suppliers, Singapore and China – where Zimbabwe imported products and services worth approximately US$1.2 billion and US$411 million respectively, according to Trade Map – have also affected as a source of raw materials and will likely impact supply to Zimbabwe.

To address these challenges, there is urgent need for diplomatic intervention to engage the source country and advise them that these raw materials feed into our essential services which our Ministry of Foreign Affairs and International Trade is currently inundated with.

Whilst the Government can assist manufacturers to source raw materials, one lesson from the COVID-19 pandemic is that there is need for companies to engage local suppliers.

This can be easily attained if players in the entire value chain can organize themselves and come up with strong supply chains.

For example, cattle farmers, leather processers and shoe manufacturer must work together to develop their value chain so that demand for imported leather is reduced.

This will solve the challenge of sourcing raw materials outside the country, which is usually difficult and expensive.

Classified of non-essential services locally

As the country is in the second phase of the lockdown, President Mnangagwa highlighted that industry should start picking up and encouraged supervised movement of people in industrial areas.

What is encouraging is that this includes manufacturers in the informal sector, who in most cases lack proper documentation.

Therefore, there is urgent need for manufacturers in the informal sector to organize themselves so that they have proper documentation.

In addition, those in the essential services should also indicate to Government their essential service providers such as refrigeration, mechanical and electrical service providers who should also be covered to carry out duties as exempted companies.

Publish Date: Sunday 26 April 2020